There’s so many younger people in this country that think the financial system is a piece of shit,” said Baiju Bhatt, co-founder of the commission-free trading app, Robinhood. Bhatt is, as so many in Silicon Valley are, out to disrupt an industry steeped in tradition — and tradition that typically favors a small group of people. “There’s this idea in traditional financial services that there are different tiers of financial citizens — like there’s first-class financial citizen, second-class financial citizen. And that’s just a thing that I disagree with, I think that’s not what financial services should be about. I mean, to think about what this industry is called, it’s called financial services; it exists to serve.”

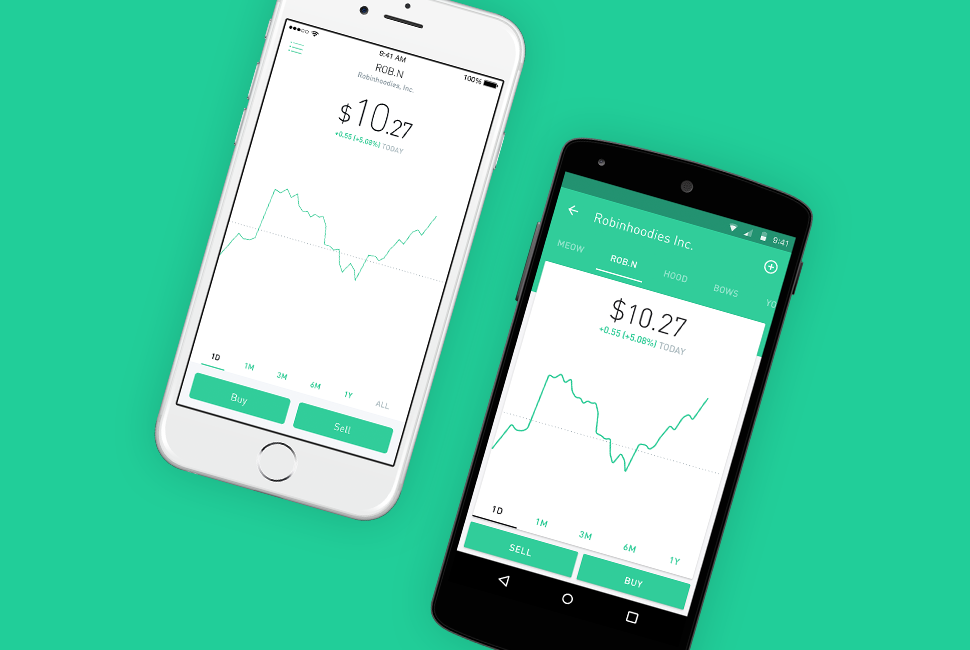

To Bhatt, investing is not simply about dollars and cents; it’s an imperative movement to closing the equality gap (which, by all measures, is only growing). The higher purpose of the Robinhood app, which launched in March 2015, is to lower the barrier to entry for prospective investors. At base, it’s a totally commission-free trading platform. In the past year, this semi-social experiment appears to be working. Robinhood has accrued one million users, and the average age is 28. To learn more about how the app has changed the stock-trading landscape, and to find out how those new to Robinhood can best leverage the app, I talked with Bhatt over the phone, from his office in Silicon Valley.

Q: What’s happened in the last year or more? Have people come flooding to you? Have companies come with cease-and-desist orders?

A: So, people have come flooding to us, which has been amazing. Robinhood is better than the other online brokers because it’s cheaper, it’s faster, it’s easier to use — unless you’re doing butterfly option trades, suspended upside down, on the Brazilian Stock Exchange or something like that. If you’re just buying some stocks, it’s the best thing that’s out there. So what we’ve seen is pretty amazing. In just one year, we’ve grown to over a million users, we’ve processed over $6 billion in investments. So, people have invested over $6 billion, bought and sold on Robinhood and we’ve saved over $100 million in commissions.

And in between just trying to keep our servers up and to keep our company running so that we’re able to keep up this astronomic growth, we’ve rolled out some pretty awesome features. I think one of the biggest two that we’ve rolled out is Robinhood Instant, which basically speeds up money transfer on all things brokerage.

Q: What does that mean? Can you explain that further?

A: So, basically, money moves slowly in the US and it moves particularly slowly when it pertains to the stock market. So there’s two things that are really slow that we sped up. The first one is that whenever you transfer money in and out of a brokerage account, it takes three days to settle. We basically engineered a way to do it instantaneously.

“It shares some of the mechanics with gambling activities, but the reason it’s different is because on average, you will make money through investment in the stock market.”