The phrase “the Internet of Things,” while coined more than a decade ago, has only recently begun to overwhelm mainstream tech vernacular, thanks to the proliferation of app-enabled devices and RFID chips. At its core, the concept is all about connectivity — less a platform confined to a screen, and more of a network by which gadgets can communicate.

The implementation of the Internet of Things has been diverse, with some applications being more practical than others. Prosaic objects, like a salt shaker or hairbrush, don’t grow any more useful with the addition of internet-enabled accelerometers. But others, both new creations and existing devices, benefit greatly from increased connectivity — like home security systems, for example.

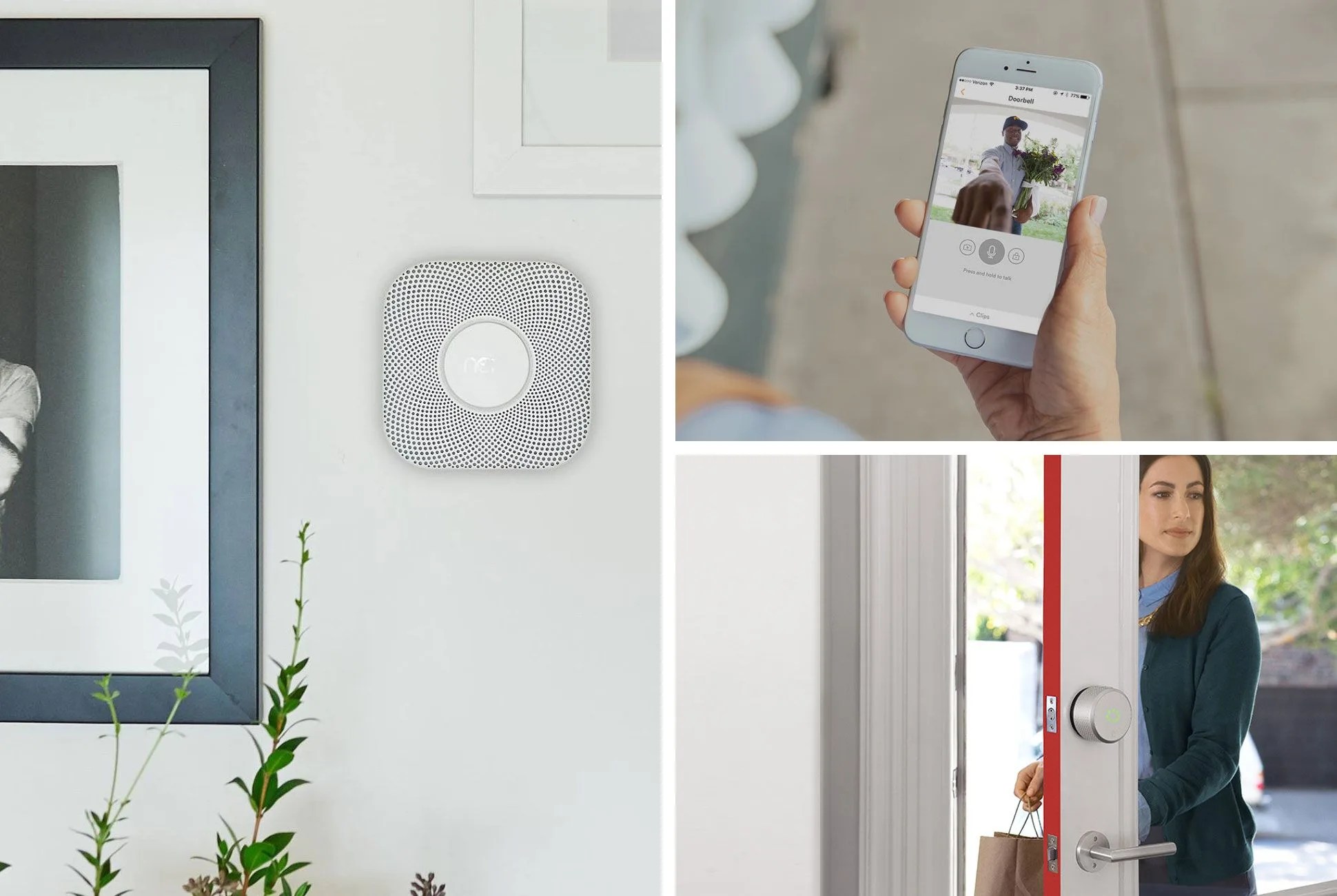

From Bluetooth-enabled door locks to light bulbs that sync with thermostats, smart home technology — while often scrutinized for the risk of cyber break-ins — is improving safety, security and energy efficiency, and insurance providers are taking note. Major companies like Nationwide, Farmers, Travelers and American Family all offer discounts to those who invest in smart products that enable improved surveillance — most on a case-by-case basis, dependent on region and specific technology.

“The goal is to encourage clients to adopt technologies that both make them personally safer and reduce the chance of having a loss — a win for everyone involved.”

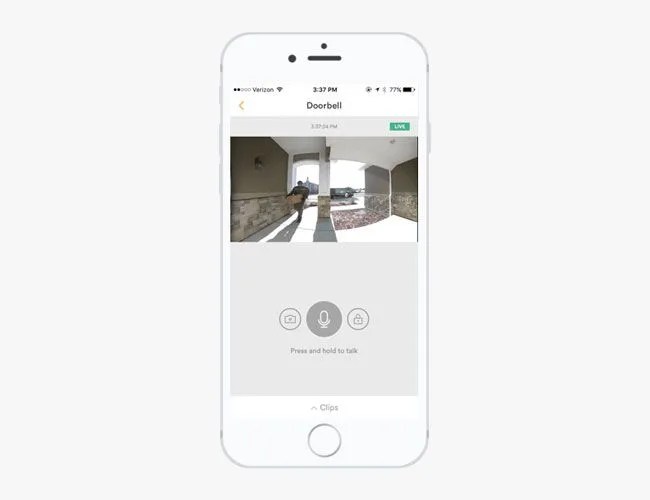

Liberty Mutual first began offering smart home discounts in 2015, specifically for the Nest Protect smoke and carbon monoxide detector and Vivint Smart Home platform. Its product roster has since expanded to include devices like the Canary security system and August Smart Lock, of which Liberty Mutual is an investor. “These technologies provide peace of mind and help to keep you safe by detecting events that trigger alerts on smartphones, wherever [customers] may be,” says Chad Lovell, managing director of strategic partnerships at Liberty Mutual Insurance, adding that while discounts vary according to levels of monitoring (audible, self-monitored or professionally monitored), insurance savings can double if a customer enables data sharing for incident verification purposes.

Similarly, State Farm has partnered with companies like ADT and Canary to offer exclusive discounts for existing customers, while Allstate offers smart home security discounts ranging from 5 to 15 percent, depending on state and specific technology, favoring systems that alert homeowners of fires or break-ins, such as Canary, and water detection and shut-off devices. Yet while insurance providers are eager to tap into smart home technologies and reward customers for adopting safe habits, nascent technologies require a great deal of financial and logistical fieldwork.

We’ll All Have Smart Homes in 10 Years: Fact or Fiction?