You don’t need to be a genius to manage your money intelligently and invest it wisely. Thanks to a handful of apps, the black box that is money management is now slightly less opaque. These apps won’t make you Gordon Gekko, nor will they suddenly unlock your inner Soros, but they will help you to be smarter about your money and could even put an extra bit of cash in your pocket.

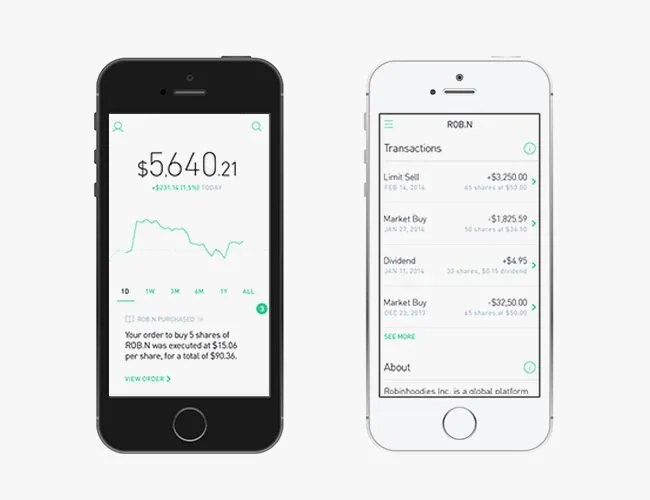

Robinhood

If you want to invest in the stock market, most brokerages and account managers charge a pretty hefty fee. And most require you to invest at least a certain amount. Robinhood allows you to invest without those restrictions. You can buy a handful of stocks and watch the markets right from the app. You can’t currently trade in overseas markets, but there are more than enough stocks in the US markets to get you started.

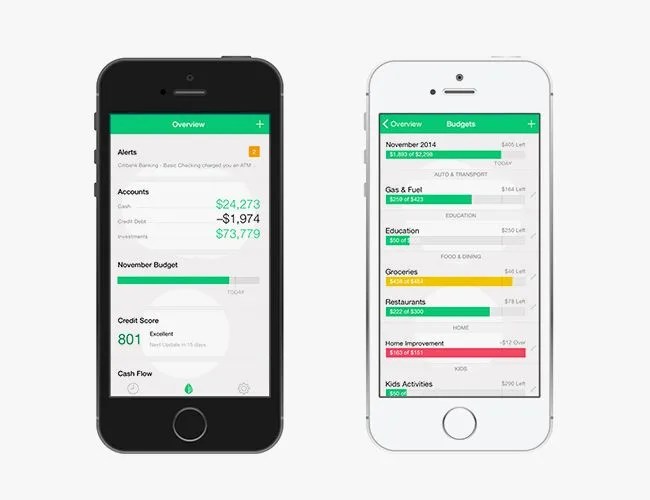

Mint

Mint allows you to compile all of your accounts into one tracking app. Whether it’s a checking account, savings, IRA, credit card — you name it, you can link it. You can then set goals and analyze your spending habits. You can even have preset limits; for example, if you only want to spend $150 a month on gas, you can set that as a spending limit and Mint will alert you when you’re getting close. It won’t cut off spending to your cards (that would be a little too Big Brother, wouldn’t it), but it’s a helpful heads-up. The app will also show you your spending trends on a graph, with purchases separated into categories, which makes it easy to see that your $10 lunches are making a dent in your income each month.