The ability for remote laborers to transfer cash to each other by texting a few digits on a dumb phone is transforming entire economies in emerging nations. It’s simple, efficient and cheap. Meanwhile, in Silicon Valley, engineers are designing more advanced breeds of money apps, platforms that seek to transform the way a different demographic saves and invests.

MORE DECRYPTED: Health is the New Gold | Facebook’s Internet.org | Why the PS4 is Winning

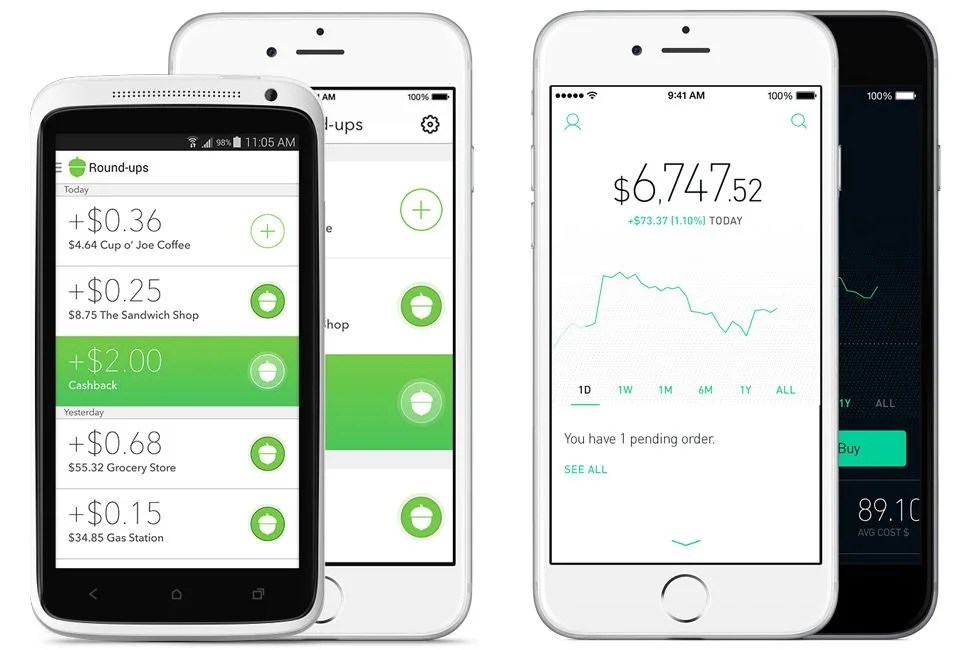

Mobile banking has been around for years now; long before smartphones were en vogue, banks situated on the cutting edge enabled patrons to send and receive cash using SMS. Transferring funds from one account to another, as it turns out, is just the start. With the explosion of online trading portals such as Scottrade and ShareBuilder, coupled with interest in new wave budgeting programs like Mint, we’ve found ourselves primed for what’s next. And what’s next is a generation of apps that make terms like “compound interest” and “annual percentage rate” seem a lot less baffling.

The Fee-Free Investor

Prior to the Internet, day trading in your pajamas wasn’t really a thing. Nowadays, there’s access to dozens upon dozens of reputable online trading services that’ll happily handle the buying and selling of stock on the open market…for a nominal per-transaction fee. Most of these services get away with charging between $5 and $10 per transaction, which adds up to a cringe-worthy amount for even amateur traders. For years, these fees have largely been viewed as the price of doing business.

Robinhood’s founders claim that they’re trying to “democratize access to the markets”; and with no commissions and no account minimums, they’re doing a fine job of that.

Robinhood just turned that entire notion on its head. The app, which has hundreds of thousands of folks using it and another 200,000 on a waiting list, enables users to buy and sell stock with no fees. Robinhood’s founders claim that they’re trying to “democratize access to the markets”; and with no commissions and no account minimums, they’re doing a fine job of that. The company makes money from those who choose to upgrade to a margin account, and it also “accrues interest off of customers’ uninvested cash balances.” But unlike E*Trade and its other rivals, the revenue stops there.