According to Joseph Einhorn, co-founder (along with digital development whiz Ashley Granata) of data and technology company The Archivist, resale sites diminish the value of archival designer goods by positing them as items to be sold for less than retail. The sales are then just a way for shoppers to save big on something from a designer they can’t actually afford. But, there are inherent risks in resale for brands that Einhorn sees as inevitable: counterfeiting, quality control issues and consumer dissatisfaction.

The vintage selling experience Einhorn envisions would be one for buyers who “view these pieces as works of art,” and have an interest in “tracing their provenance and appreciating their timeless qualities.” These consumers see past season’s jackets and accessories as collector’s items; things that accrue value; things meant to be cherished. There are more and more consumers like this, who choose to shop this way — like they’re hunting for fine art.

The Archivist

The ArchivistIf brands reclaimed control of their archival inventory, Einhorn explains, they’d get to oversee the resale of their products, pulling items off sites like Ebay, Grailed, GOAT, StockX, TheRealReal or Vestiaire Collective and back into their own ecosystem, where messaging, monetary value and consumer experience are under their direction. In the same way artists are removed from sales beyond the first transaction, brands are too; but they’re tired of being excluded.

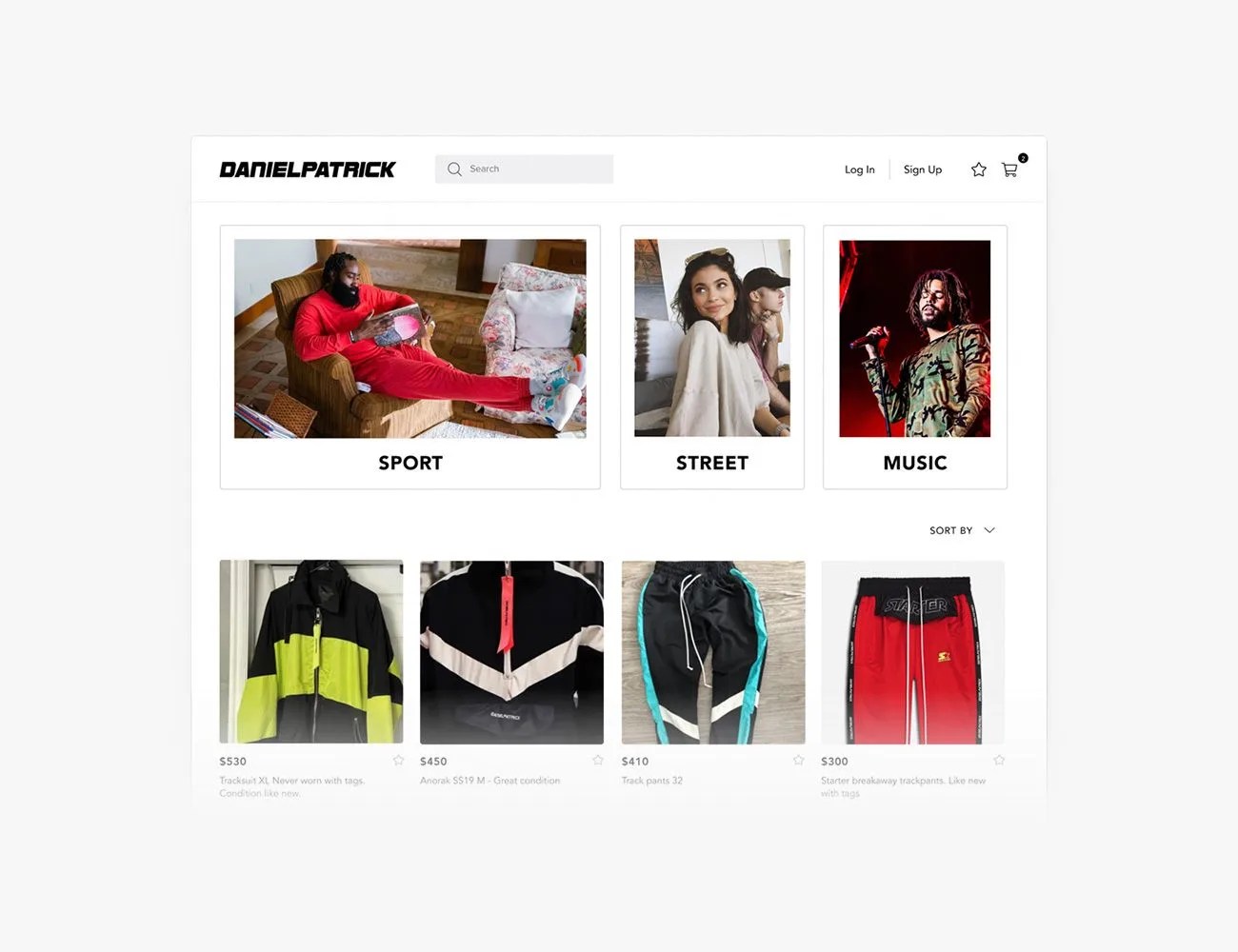

LA-based designer Daniel Patrick began taking back his archives last month with the launch of his The Archivist hub — danielpatrick.thearchivist.com. On it, clothing and footwear from past seasons are listed by third-party sellers. Patrick’s team, however, has a hand in every step of the process — from approving listings and product images to communicating with the customer when the shipment has departed and will be delivered.

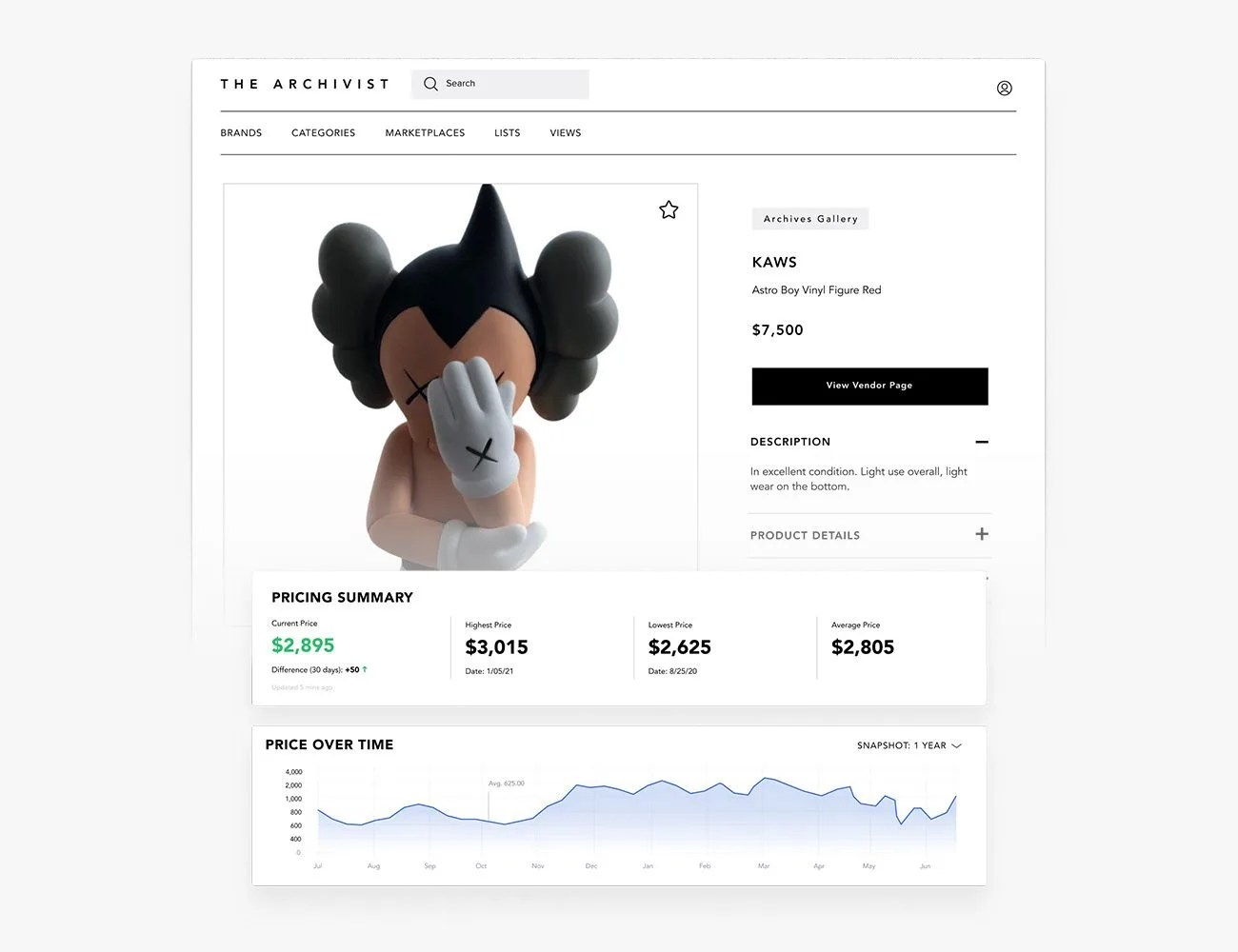

Ushering brands through the launch of their own store is only half of The Archivist’s mission, though. The foundation of the company is data: which vintage items from a given brand are selling well, how abundant they are, where they’re being sold, what condition they’re in and many other metrics. The Archivist crawls thousands of sites and millions of listings worldwide to offer brands “the Bloomberg terminal of resale.” There, brands get an informed look at the entire archival luxury market and are encouraged to base brand decisions on it.

The Archivist

The Archivist